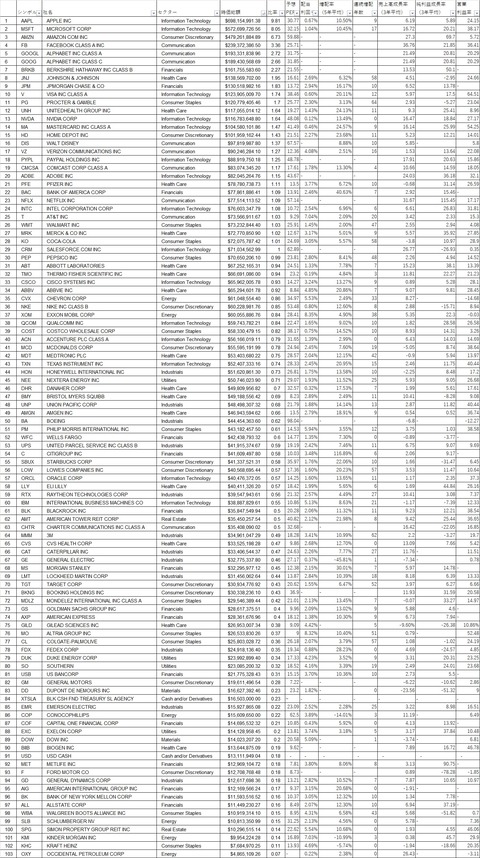

米国を代表する企業100社で構成されるS&P100。その銘柄と基本データを簡単に理解しておくことは市場をよりクリアに見通し適切な銘柄を選択するのに役立ちます。ということで、この記事ではS&P100構成銘柄の一覧と基本データをまとめています。項目と出典は以下の通り。

※2020年12月6日時点

項目が多いので2つに分けました。まずは以下をご紹介。

・シンボル

・社名

・セクター

・時価総額

・構成比率

続いて以下をご紹介。

・予想PER

・配当利回り

・5年間の増配率(年平均)

・連続増配年数※

・3年間の売上高成長率(年平均)

・3年間の純利益成長率(年平均)

・営業利益率

※例えば配当王であるはずのEMRの増配年数が25年になっているなど、Seeking Alphaの連続増配年数の算出方法は配当王、配当貴族のものとは少し異なるようです。

最後に一枚絵も載せておきます。画像の方が見やすい方はこちらからどうぞ。

銘柄/セクター/時価総額/比率:iShares

予想PER/配当利回り/売上成長率/純利益成長率/営業利益率:Morningstar

増配率/連続増配年数:Seeking Alpha

※2020年12月6日時点

項目が多いので2つに分けました。まずは以下をご紹介。

・シンボル

・社名

・セクター

・時価総額

・構成比率

| シンボル | 社名 | セクター | 時価総額 | 比率 | |

| 1 | AAPL | APPLE INC | Information Technology | $698,154,991.38 | 9.81 |

| 2 | MSFT | MICROSOFT CORP | Information Technology | $572,699,726.56 | 8.05 |

| 3 | AMZN | AMAZON COM INC | Consumer Discretionary | $479,261,884.89 | 6.73 |

| 4 | FB | FACEBOOK CLASS A INC | Communication | $239,372,386.50 | 3.36 |

| 5 | GOOGL | ALPHABET INC CLASS A | Communication | $193,331,838.96 | 2.72 |

| 6 | GOOG | ALPHABET INC CLASS C | Communication | $189,430,568.69 | 2.66 |

| 7 | BRKB | BERKSHIRE HATHAWAY INC CLASS B | Financials | $161,755,583.60 | 2.27 |

| 8 | JNJ | JOHNSON & JOHNSON | Health Care | $138,569,702.00 | 1.95 |

| 9 | JPM | JPMORGAN CHASE & CO | Financials | $130,518,982.16 | 1.83 |

| 10 | V | VISA INC CLASS A | Information Technology | $123,905,009.70 | 1.74 |

| 11 | PG | PROCTER & GAMBLE | Consumer Staples | $120,779,405.46 | 1.7 |

| 12 | UNH | UNITEDHEALTH GROUP INC | Health Care | $117,055,014.12 | 1.64 |

| 13 | NVDA | NVIDIA CORP | Information Technology | $116,783,648.80 | 1.64 |

| 14 | MA | MASTERCARD INC CLASS A | Information Technology | $104,580,101.86 | 1.47 |

| 15 | HD | HOME DEPOT INC | Consumer Discretionary | $101,959,162.44 | 1.43 |

| 16 | DIS | WALT DISNEY | Communication | $97,819,987.80 | 1.37 |

| 17 | VZ | VERIZON COMMUNICATIONS INC | Communication | $90,246,284.10 | 1.27 |

| 18 | PYPL | PAYPAL HOLDINGS INC | Information Technology | $88,919,750.18 | 1.25 |

| 19 | CMCSA | COMCAST CORP CLASS A | Communication | $83,074,345.20 | 1.17 |

| 20 | ADBE | ADOBE INC | Information Technology | $82,045,264.76 | 1.15 |

| 21 | PFE | PFIZER INC | Health Care | $78,780,738.73 | 1.11 |

| 22 | BAC | BANK OF AMERICA CORP | Financials | $77,861,886.41 | 1.09 |

| 23 | NFLX | NETFLIX INC | Communication | $77,514,113.52 | 1.09 |

| 24 | INTC | INTEL CORPORATION CORP | Information Technology | $76,603,347.79 | 1.08 |

| 25 | T | AT&T INC | Communication | $73,566,911.67 | 1.03 |

| 26 | WMT | WALMART INC | Consumer Staples | $73,232,844.40 | 1.03 |

| 27 | MRK | MERCK & CO INC | Health Care | $72,770,850.90 | 1.02 |

| 28 | KO | COCA-COLA | Consumer Staples | $72,075,787.42 | 1.01 |

| 29 | CRM | SALESFORCE.COM INC | Information Technology | $71,034,562.99 | 1 |

| 30 | PEP | PEPSICO INC | Consumer Staples | $70,650,206.10 | 0.99 |

| 31 | ABT | ABBOTT LABORATORIES | Health Care | $67,252,165.31 | 0.94 |

| 32 | TMO | THERMO FISHER SCIENTIFIC INC | Health Care | $66,691,086.00 | 0.94 |

| 33 | CSCO | CISCO SYSTEMS INC | Information Technology | $65,962,005.78 | 0.93 |

| 34 | ABBV | ABBVIE INC | Health Care | $65,294,601.78 | 0.92 |

| 35 | CVX | CHEVRON CORP | Energy | $61,048,554.40 | 0.86 |

| 36 | NKE | NIKE INC CLASS B | Consumer Discretionary | $60,228,981.76 | 0.85 |

| 37 | XOM | EXXON MOBIL CORP | Energy | $60,055,886.76 | 0.84 |

| 38 | QCOM | QUALCOMM INC | Information Technology | $59,743,782.21 | 0.84 |

| 39 | COST | COSTCO WHOLESALE CORP | Consumer Staples | $58,330,479.15 | 0.82 |

| 40 | ACN | ACCENTURE PLC CLASS A | Information Technology | $56,166,019.11 | 0.79 |

| 41 | MCD | MCDONALDS CORP | Consumer Discretionary | $55,595,191.99 | 0.78 |

| 42 | MDT | MEDTRONIC PLC | Health Care | $53,403,680.22 | 0.75 |

| 43 | TXN | TEXAS INSTRUMENT INC | Information Technology | $52,407,333.16 | 0.74 |

| 44 | HON | HONEYWELL INTERNATIONAL INC | Industrials | $51,620,861.30 | 0.73 |

| 45 | NEE | NEXTERA ENERGY INC | Utilities | $50,746,023.90 | 0.71 |

| 46 | DHR | DANAHER CORP | Health Care | $49,809,956.82 | 0.7 |

| 47 | BMY | BRISTOL MYERS SQUIBB | Health Care | $49,188,556.42 | 0.69 |

| 48 | UNP | UNION PACIFIC CORP | Industrials | $48,498,307.32 | 0.68 |

| 49 | AMGN | AMGEN INC | Health Care | $46,943,594.62 | 0.66 |

| 50 | BA | BOEING | Industrials | $44,454,363.60 | 0.62 |

| 51 | PM | PHILIP MORRIS INTERNATIONAL INC | Consumer Staples | $43,182,457.50 | 0.61 |

| 52 | WFC | WELLS FARGO | Financials | $42,438,793.32 | 0.6 |

| 53 | UPS | UNITED PARCEL SERVICE INC CLASS B | Industrials | $41,915,374.67 | 0.59 |

| 54 | C | CITIGROUP INC | Financials | $41,609,497.80 | 0.58 |

| 55 | SBUX | STARBUCKS CORP | Consumer Discretionary | $41,337,521.31 | 0.58 |

| 56 | LOW | LOWES COMPANIES INC | Consumer Discretionary | $40,568,695.44 | 0.57 |

| 57 | ORCL | ORACLE CORP | Information Technology | $40,476,372.05 | 0.57 |

| 58 | LLY | ELI LILLY | Health Care | $40,411,326.20 | 0.57 |

| 59 | RTX | RAYTHEON TECHNOLOGIES CORP | Industrials | $39,547,943.61 | 0.56 |

| 60 | IBM | INTERNATIONAL BUSINESS MACHINES CO | Information Technology | $38,887,829.61 | 0.55 |

| 61 | BLK | BLACKROCK INC | Financials | $35,847,549.94 | 0.5 |

| 62 | AMT | AMERICAN TOWER REIT CORP | Real Estate | $35,450,257.54 | 0.5 |

| 63 | CHTR | CHARTER COMMUNICATIONS INC CLASS A | Communication | $35,408,090.02 | 0.5 |

| 64 | MMM | 3M | Industrials | $34,961,047.29 | 0.49 |

| 65 | CVS | CVS HEALTH CORP | Health Care | $33,525,198.28 | 0.47 |

| 66 | CAT | CATERPILLAR INC | Industrials | $33,406,544.37 | 0.47 |

| 67 | GE | GENERAL ELECTRIC | Industrials | $32,775,337.80 | 0.46 |

| 68 | MS | MORGAN STANLEY | Financials | $32,295,977.12 | 0.45 |

| 69 | LMT | LOCKHEED MARTIN CORP | Industrials | $31,456,062.64 | 0.44 |

| 70 | TGT | TARGET CORP | Consumer Discretionary | $30,934,776.92 | 0.43 |

| 71 | BKNG | BOOKING HOLDINGS INC | Consumer Discretionary | $30,338,236.10 | 0.43 |

| 72 | MDLZ | MONDELEZ INTERNATIONAL INC CLASS A | Consumer Staples | $29,546,389.44 | 0.42 |

| 73 | GS | GOLDMAN SACHS GROUP INC | Financials | $28,617,375.51 | 0.4 |

| 74 | AXP | AMERICAN EXPRESS | Financials | $28,361,676.96 | 0.4 |

| 75 | GILD | GILEAD SCIENCES INC | Health Care | $26,953,007.34 | 0.38 |

| 76 | MO | ALTRIA GROUP INC | Consumer Staples | $26,533,830.26 | 0.37 |

| 77 | CL | COLGATE-PALMOLIVE | Consumer Staples | $25,803,028.72 | 0.36 |

| 78 | FDX | FEDEX CORP | Industrials | $24,918,136.40 | 0.35 |

| 79 | DUK | DUKE ENERGY CORP | Utilities | $23,992,899.40 | 0.34 |

| 80 | SO | SOUTHERN | Utilities | $23,085,200.32 | 0.32 |

| 81 | USB | US BANCORP | Financials | $21,775,328.43 | 0.31 |

| 82 | GM | GENERAL MOTORS | Consumer Discretionary | $19,611,496.54 | 0.28 |

| 83 | DD | DUPONT DE NEMOURS INC | Materials | $16,627,392.46 | 0.23 |

| 84 | XTSLA | BLK CSH FND TREASURY SL AGENCY | Cash and/or Derivatives | $16,503,000.00 | 0.23 |

| 85 | EMR | EMERSON ELECTRIC | Industrials | $15,927,865.08 | 0.22 |

| 86 | COP | CONOCOPHILLIPS | Energy | $15,609,650.00 | 0.22 |

| 87 | COF | CAPITAL ONE FINANCIAL CORP | Financials | $14,695,532.32 | 0.21 |

| 88 | EXC | EXELON CORP | Utilities | $14,128,958.45 | 0.2 |

| 89 | DOW | DOW INC | Materials | $14,023,207.20 | 0.2 |

| 90 | BIIB | BIOGEN INC | Health Care | $13,644,875.09 | 0.19 |

| 91 | USD | USD CASH | Cash and/or Derivatives | $13,111,949.04 | 0.18 |

| 92 | MET | METLIFE INC | Financials | $12,969,104.72 | 0.18 |

| 93 | F | FORD MOTOR CO | Consumer Discretionary | $12,708,768.48 | 0.18 |

| 94 | GD | GENERAL DYNAMICS CORP | Industrials | $12,617,698.36 | 0.18 |

| 95 | AIG | AMERICAN INTERNATIONAL GROUP INC | Financials | $12,169,566.24 | 0.17 |

| 96 | BK | BANK OF NEW YORK MELLON CORP | Financials | $11,593,516.52 | 0.16 |

| 97 | ALL | ALLSTATE CORP | Financials | $11,449,230.27 | 0.16 |

| 98 | WBA | WALGREEN BOOTS ALLIANCE INC | Consumer Staples | $10,919,314.10 | 0.15 |

| 99 | SLB | SCHLUMBERGER NV | Energy | $10,813,350.99 | 0.15 |

| 100 | SPG | SIMON PROPERTY GROUP REIT INC | Real Estate | $10,296,515.14 | 0.14 |

| 101 | KMI | KINDER MORGAN INC | Energy | $9,954,224.28 | 0.14 |

| 102 | KHC | KRAFT HEINZ | Consumer Staples | $7,684,970.25 | 0.11 |

| 103 | OXY | OCCIDENTAL PETROLEUM CORP | Energy | $4,865,109.26 | 0.07 |

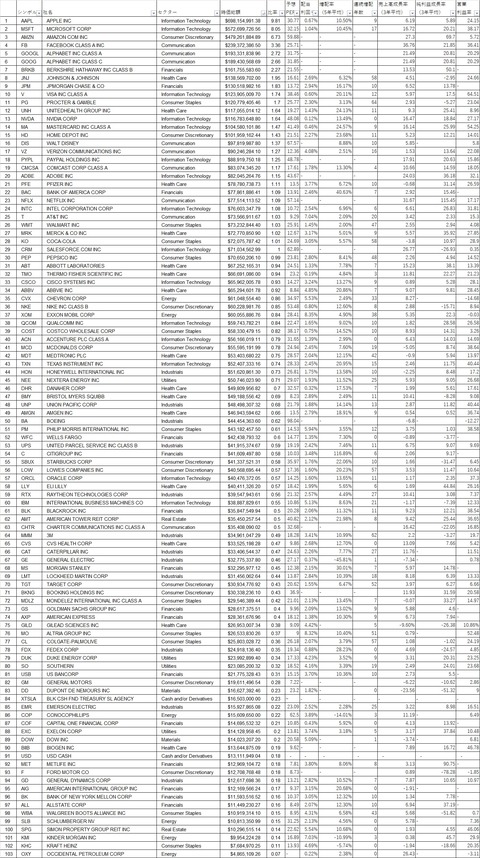

続いて以下をご紹介。

・予想PER

・配当利回り

・5年間の増配率(年平均)

・連続増配年数※

・3年間の売上高成長率(年平均)

・3年間の純利益成長率(年平均)

・営業利益率

※例えば配当王であるはずのEMRの増配年数が25年になっているなど、Seeking Alphaの連続増配年数の算出方法は配当王、配当貴族のものとは少し異なるようです。

| シンボル | 社名 | 予想 PER |

配当 利回り |

増配率 (5年平均) |

連続増配 年数 |

売上高成長率 (3年平均) |

純利益成長率 (3年平均) |

営業 利益率 |

| AAPL | APPLE INC | 30.77 | 0.67% | 10.50% | 9 | 6.19 | 5.89 | 24.15 |

| MSFT | MICROSOFT CORP | 32.15 | 1.04% | 10.45% | 17 | 16.72 | 20.21 | 38.17 |

| AMZN | AMAZON COM INC | 59.88 | - | - | - | 27.3 | 69.7 | 5.72 |

| FB | FACEBOOK CLASS A INC | 25.71 | - | - | - | 36.76 | 21.85 | 36.41 |

| GOOGL | ALPHABET INC CLASS A | 31.75 | - | - | - | 21.49 | 20.81 | 20.29 |

| GOOG | ALPHABET INC CLASS C | 31.85 | - | - | - | 21.49 | 20.81 | 20.29 |

| BRKB | BERKSHIRE HATHAWAY INC CLASS B | 21.55 | - | - | - | 13.53 | 50.1 | - |

| JNJ | JOHNSON & JOHNSON | 16.61 | 2.69% | 6.32% | 58 | 4.51 | -2.95 | 24.66 |

| JPM | JPMORGAN CHASE & CO | 13.72 | 2.94% | 16.17% | 10 | 6.52 | 13.78 | - |

| V | VISA INC CLASS A | 38.46 | 0.60% | 20.11% | 12 | 5.97 | 17.5 | 64.51 |

| PG | PROCTER & GAMBLE | 25.77 | 2.30% | 3.13% | 64 | 2.93 | -5.27 | 23.04 |

| UNH | UNITEDHEALTH GROUP INC | 19.27 | 1.43% | 24.13% | 11 | 9.3 | 25.41 | 8.96 |

| NVDA | NVIDIA CORP | 48.08 | 0.12% | 13.49% | 0 | 16.47 | 18.84 | 27.17 |

| MA | MASTERCARD INC CLASS A | 41.49 | 0.46% | 24.57% | 9 | 16.14 | 25.99 | 54.25 |

| HD | HOME DEPOT INC | 21.51 | 2.27% | 23.68% | 11 | 5.23 | 12.21 | 14.01 |

| DIS | WALT DISNEY | 67.57 | - | 8.88% | 10 | 5.85 | - | 5.8 |

| VZ | VERIZON COMMUNICATIONS INC | 12.36 | 4.08% | 2.51% | 16 | 1.53 | 13.64 | 22.08 |

| PYPL | PAYPAL HOLDINGS INC | 48.78 | - | - | - | 17.91 | 20.63 | 15.86 |

| CMCSA | COMCAST CORP CLASS A | 17.61 | 1.78% | 13.30% | 4 | 10.66 | 14.59 | 18.05 |

| ADBE | ADOBE INC | 43.67 | - | - | - | 24.03 | 36.18 | 32.1 |

| PFE | PFIZER INC | 13.5 | 3.77% | 6.72% | 10 | -0.68 | 31.14 | 26.59 |

| BAC | BANK OF AMERICA CORP | 13.91 | 2.46% | 40.63% | 7 | 2.92 | 15.46 | - |

| NFLX | NETFLIX INC | 57.14 | - | - | - | 31.67 | 115.45 | 17.17 |

| INTC | INTEL CORPORATION CORP | 10.72 | 2.54% | 6.96% | 6 | 6.61 | 26.83 | 31.81 |

| T | AT&T INC | 9.29 | 7.04% | 2.09% | 20 | 3.42 | 2.33 | 15.3 |

| WMT | WALMART INC | 25.91 | 1.45% | 2.00% | 47 | 2.55 | 2.94 | 4.08 |

| MRK | MERCK & CO INC | 12.67 | 3.17% | 5.01% | 9 | 5.57 | 35.92 | 27.85 |

| KO | COCA-COLA | 24.69 | 3.05% | 5.57% | 58 | -3.8 | 10.97 | 28.9 |

| CRM | SALESFORCE.COM INC | 62.89 | - | - | - | 26.77 | -26.93 | 0.35 |

| PEP | PEPSICO INC | 23.81 | 2.80% | 8.41% | 48 | 2.26 | 4.94 | 14.52 |

| ABT | ABBOTT LABORATORIES | 24.51 | 1.33% | 7.78% | 7 | 15.23 | 38.1 | 13.39 |

| TMO | THERMO FISHER SCIENTIFIC INC | 23.2 | 0.19% | 4.84% | 3 | 11.81 | 22.27 | 21.23 |

| CSCO | CISCO SYSTEMS INC | 14.27 | 3.24% | 13.27% | 9 | 0.89 | 5.28 | 28.1 |

| ABBV | ABBVIE INC | 8.84 | 4.85% | 20.86% | 7 | 9.07 | 9.81 | 28.45 |

| CVX | CHEVRON CORP | 34.97 | 5.53% | 2.49% | 33 | 8.27 | - | -14.68 |

| NKE | NIKE INC CLASS B | 53.48 | 0.80% | 12.60% | 8 | 2.88 | -15.71 | 8.94 |

| XOM | EXXON MOBIL CORP | 28.41 | 8.35% | 4.90% | 38 | 5.35 | 22.3 | -0.03 |

| QCOM | QUALCOMM INC | 22.47 | 1.65% | 9.02% | 10 | 1.82 | 28.58 | 26.58 |

| COST | COSTCO WHOLESALE CORP | 38.17 | 0.75% | 14.52% | 10 | 8.93 | 14.31 | 3.26 |

| ACN | ACCENTURE PLC CLASS A | 31.65 | 1.39% | 2.99% | 0 | 6.43 | 14.03 | 14.69 |

| MCD | MCDONALDS CORP | 24.94 | 2.45% | 7.60% | 19 | -5.05 | 8.74 | 38.64 |

| MDT | MEDTRONIC PLC | 28.57 | 2.04% | 12.15% | 42 | -0.9 | 5.94 | 13.97 |

| TXN | TEXAS INSTRUMENT INC | 28.33 | 2.45% | 20.95% | 15 | 2.46 | 11.75 | 40.44 |

| HON | HONEYWELL INTERNATIONAL INC | 26.81 | 1.75% | 13.58% | 10 | -2.25 | 8.48 | 17.2 |

| NEE | NEXTERA ENERGY INC | 29.07 | 1.93% | 11.52% | 25 | 5.93 | 9.05 | 26.68 |

| DHR | DANAHER CORP | 32.57 | 0.32% | 17.53% | 7 | 1.99 | 5.61 | 17.61 |

| BMY | BRISTOL MYERS SQUIBB | 8.23 | 2.89% | 2.49% | 11 | 10.41 | -8.28 | 9.08 |

| UNP | UNION PACIFIC CORP | 21.79 | 1.88% | 14.14% | 13 | 2.87 | 11.82 | 40.44 |

| AMGN | AMGEN INC | 13.5 | 2.79% | 18.91% | 9 | 0.54 | 0.52 | 36.74 |

| BA | BOEING | 98.04 | - | - | - | -6.8 | - | -12.27 |

| PM | PHILIP MORRIS INTERNATIONAL INC | 14.53 | 5.94% | 3.55% | 12 | 3.75 | 1.03 | 38.58 |

| WFC | WELLS FARGO | 14.77 | 1.35% | 7.30% | 0 | -0.89 | -3.77 | - |

| UPS | UNITED PARCEL SERVICE INC CLASS B | 19.19 | 2.42% | 7.46% | 11 | 6.75 | 9.07 | 9.69 |

| C | CITIGROUP INC | 10.03 | 3.48% | 116.89% | 6 | 2.06 | 9.17 | - |

| SBUX | STARBUCKS CORP | 35.97 | 1.76% | 22.06% | 10 | 1.66 | -31.47 | 6.45 |

| LOW | LOWES COMPANIES INC | 17.36 | 1.60% | 20.23% | 57 | 3.53 | 11.47 | 10.64 |

| ORCL | ORACLE CORP | 14.25 | 1.60% | 13.65% | 11 | 1.17 | 2.35 | 37.3 |

| LLY | ELI LILLY | 18.42 | 1.99% | 5.65% | 6 | 1.69 | 44.84 | 26.16 |

| RTX | RAYTHEON TECHNOLOGIES CORP | 21.32 | 2.57% | 4.49% | 27 | 10.41 | 3.08 | 7.37 |

| IBM | INTERNATIONAL BUSINESS MACHINES CO | 10.86 | 5.13% | 8.63% | 21 | -1.17 | -7.39 | 12.33 |

| BLK | BLACKROCK INC | 20.28 | 2.06% | 11.32% | 11 | 9.23 | 12.21 | 38.54 |

| AMT | AMERICAN TOWER REIT CORP | 40.82 | 2.12% | 21.98% | 8 | 9.42 | 25.44 | 36.65 |

| CHTR | CHARTER COMMUNICATIONS INC CLASS A | 32.68 | - | - | - | 16.42 | -22.05 | 16.85 |

| MMM | 3M | 18.28 | 3.41% | 10.99% | 62 | 2.2 | -3.27 | 19.7 |

| CVS | CVS HEALTH CORP | 9.86 | 2.68% | 12.70% | 0 | 13.09 | 7.66 | 5.42 |

| CAT | CATERPILLAR INC | 24.63 | 2.26% | 7.77% | 27 | 11.76 | - | 11.51 |

| GE | GENERAL ELECTRIC | 27.17 | 0.37% | -45.81% | 1 | -7.34 | - | 0.78 |

| MS | MORGAN STANLEY | 12.38 | 2.15% | 30.01% | 7 | 5.97 | 14.78 | - |

| LMT | LOCKHEED MARTIN CORP | 13.87 | 2.84% | 10.39% | 18 | 8.18 | 6.39 | 13.33 |

| TGT | TARGET CORP | 20.62 | 1.55% | 6.47% | 52 | 3.97 | 6.27 | 6.66 |

| BKNG | BOOKING HOLDINGS INC | 36.9 | - | - | - | 11.93 | 31.59 | 20.58 |

| MDLZ | MONDELEZ INTERNATIONAL INC CLASS A | 21.01 | 2.13% | 13.45% | 7 | -0.07 | 33.27 | 14.97 |

| GS | GOLDMAN SACHS GROUP INC | 9.96 | 2.09% | 13.02% | 9 | 5.88 | 4.6 | - |

| AXP | AMERICAN EXPRESS | 18.12 | 1.38% | 10.30% | 9 | 6.73 | 7.94 | - |

| GILD | GILEAD SCIENCES INC | 9.09 | 4.42% | - | 5 | -9.60% | -26.38 | 10.86% |

| MO | ALTRIA GROUP INC | 9 | 8.32% | 10.40% | 51 | 0.79 | - | 52.48 |

| CL | COLGATE-PALMOLIVE | 26.18 | 2.07% | 3.79% | 57 | 1.08 | -1.02 | 24.19 |

| FDX | FEDEX CORP | 19.34 | 0.88% | 28.23% | 0 | 4.69 | -24.57 | 4.85 |

| DUK | DUKE ENERGY CORP | 17.33 | 4.23% | 3.52% | 9 | 3.31 | 20.31 | 23.25 |

| SO | SOUTHERN | 18.52 | 4.16% | 3.39% | 19 | 2.49 | 24.01 | 23.68 |

| USB | US BANCORP | 15.15 | 3.70% | 10.36% | 10 | 2.73 | 5.5 | - |

| GM | GENERAL MOTORS | 7.22 | - | - | - | -6.22 | -10.62 | 2.86 |

| DD | DUPONT DE NEMOURS INC | 23.2 | 1.82% | - | 0 | -23.56 | -51.32 | 9 |

| XTSLA | BLK CSH FND TREASURY SL AGENCY | - | - | - | - | - | - | - |

| EMR | EMERSON ELECTRIC | 23.09 | 2.52% | 2.28% | 25 | 3.22 | 8.98 | 16.51 |

| COP | CONOCOPHILLIPS | 62.5 | 3.89% | -14.01% | 3 | 11.19 | - | 6.49 |

| COF | CAPITAL ONE FINANCIAL CORP | 10.85 | 0.43% | 5.92% | 0 | 4.13 | 13.92 | - |

| EXC | EXELON CORP | 13.81 | 3.74% | 3.18% | 5 | 3.17 | 37.84 | 10.48 |

| DOW | DOW INC | 20.58 | 5.09% | - | 1 | -3.74 | - | 6.81 |

| BIIB | BIOGEN INC | 9.62 | - | - | - | 7.89 | 16.72 | 46.78 |

| USD | USD CASH | - | - | - | - | - | - | - |

| MET | METLIFE INC | 7.81 | 3.80% | 8.06% | 8 | 3.13 | 90.75 | - |

| F | FORD MOTOR CO | 8.73 | - | - | - | 0.89 | -78.28 | -1.85 |

| GD | GENERAL DYNAMICS CORP | 13.21 | 2.82% | 10.52% | 7 | 7.87 | 10.65 | 10.97 |

| AIG | AMERICAN INTERNATIONAL GROUP INC | 9.37 | 3.15% | 20.68% | 0 | -1.91 | - | - |

| BK | BANK OF NEW YORK MELLON CORP | 10.37 | 3.05% | 12.32% | 10 | 1.34 | 7.78 | - |

| ALL | ALLSTATE CORP | 8.49 | 2.07% | 12.30% | 10 | 6.94 | 37.19 | - |

| WBA | WALGREEN BOOTS ALLIANCE INC | 8.95 | 4.31% | 6.58% | 43 | 5.68 | -51.82 | 0.7 |

| SLB | SCHLUMBERGER NV | 31.25 | 2.13% | 4.56% | 0 | 5.78 | - | 7.36 |

| SPG | SIMON PROPERTY GROUP REIT INC | 22.62 | 5.54% | 10.68% | 0 | 1.93 | 4.55 | 46.06 |

| KMI | KINDER MORGAN INC | 16.89 | 7.03% | -10.99% | 3 | 0.38 | 45.7 | 29.9 |

| KHC | KRAFT HEINZ | 13.93 | 4.69% | -5.74% | 0 | -1.94 | -18.66 | 20.35 |

| OXY | OCCIDENTAL PETROLEUM CORP | - | 0.22% | 2.38% | 0 | 26.43 | - | -3.11 |

最後に一枚絵も載せておきます。画像の方が見やすい方はこちらからどうぞ。

コメント